Now is the Time to Cut Down on Debt

Reducing the number of credit cards is a necessary evil at some point. Unfortunately, it is probably not a day of celebration for those with a great deal of credit card debt. However, if you can see it through, the relief of little to no debt as the months pass will be even greater.

Most consumers want everything instantly, including payment for what they want now. The flip side is those quick charges can add up faster than realized. When using cash, you see the amount lessen and what is left. If you use credit, it’s challenging to track how much is spent on a day-to-day basis before the monthly statement arrives. Then ouch!

To help reduce debt, consider doing the following:

Set and stick to a budget. Knowing exactly how much is coming in through your income and the amount going out through expenses, you’ll have a closer idea of where your money is going. Then evaluate monthly expenses, which are essential, and what is extra or frivolous. Finally, consider which things can reduce spending. May be fewer channel subscriptions? Enjoy eating out less? Skip the morning coffee run and make it at home instead. Stay-cation this year? Clothes and shoes? Look closely at the list and see what truly can be cut.

Next, hide the cards! How can you eliminate card debt if you continue to use it and add more to the balance? It is impossible to get to a zero balance this way. Instead, use cash or a debit card so you won’t regress.

Decide your payoff approach. One option is called the snowball method. It’s where you’ll pay the minimum on every card balance while at the same time putting extra money toward the lowest balance. Once paid off, that extra amount is used to pay the next highest balance. Another method, avalanche, minimizes the total interest you’ll pay. You’ll pay the minimum payment on all and put extra money towards the balance with the highest interest. Once that balance is gone, pay more on the next highest interest. Another plan is to consolidate all the debt into a low-interest loan. Depending on your circumstances, it could include credit cards, auto, and other bills.

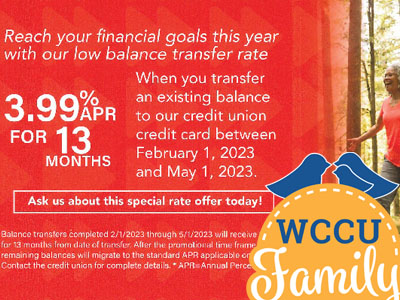

Finally, consider transferring all the cards into one with a no or low introductory rate. This helps to keep all card debt in one place for easier tracking. It also provides a specific time frame for paying the introductory interest rate so you can pay it off quickly.

Too much debt not only hurts your wallet but can add to your anxiety and decreases your credit score, all things that make life more stressful. Why wait? Talk to a Winnebago Community Credit Union today and start reducing your debt today.